This article was originally created by Mr. Wang, who is the member of Ultiledger community, and we welcome more community members to contribute great articles.

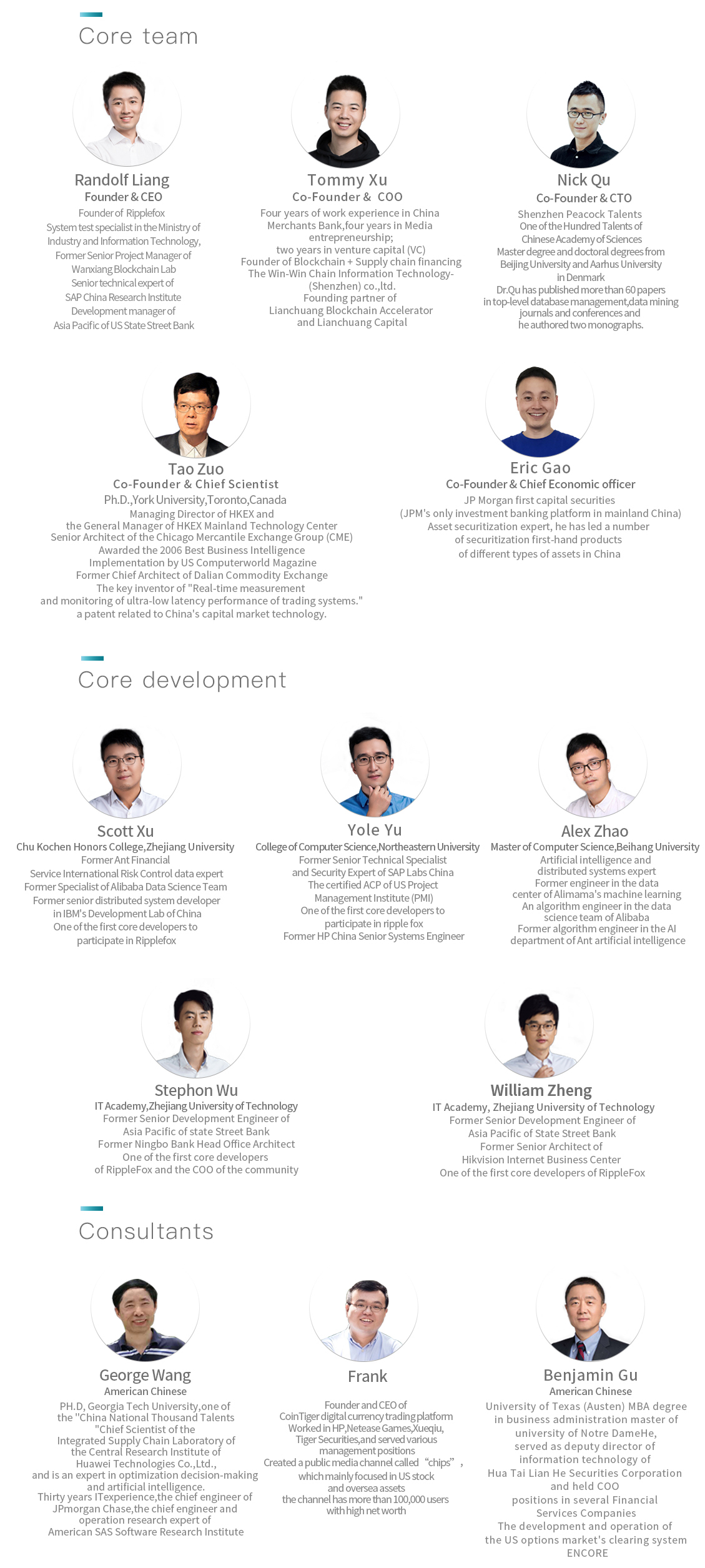

Ultiledger, the next generation of self-financing protocol is a group of ambitious young people who have the dream of “technology changes the world, financing will be universal to people”. The project sponsor and founder Randolf Liang is a technical geek. After graduating from Zhejiang University, Randolf Liang entered State Street Bank, which is the world-famous investment bank, and worked as a technology developer in the Asia Pacific headquarters. He began a period of “code change world” in the large investment bank.

As a world-famous investment bank, State Street Bank’s clients are mainly large financial institutions and sovereign countries, providing a full range of financial services for the large economies. Randolf Liang has practiced his technical capabilities and has achieved his dreams of “technology changes the world” in such a large organization; however, he felt that something was still been missed in his world.

There was a time when Randolf Liang was communicating with a classmate who was a business owner, and Randolf Liang discovered that what he had done had nothing to do with the business of his classmate. The sense of his accomplishment was weakened at the time, and he began to think about “why those SMEs are unable to enjoy my technological achievements?”.

At this time, on the dream of “technology changes the world”, Randolf Liang has created a new pursuit of “technical affirmation”. In addition to his work, Randolf Liang began to study the issue of how the achievements of technology and finance can be shared to more people. After the emergence of bitcoin and blockchain technology, Randolf Liang began to pay attention in the early stage.

With the simple ideal of “technical affirmation” and “financial inclusiveness”, Randolf Liang had a deep observation and study of bitcoin and Ethereum’s smart contract technology, his research and mastery of the underlying technology of blockchain has been very strong, and he also met some geeks in the technical circle.

After Randolf Liang discovered the technology of Ripple and Stellar, especially as a new generation of blockchain technology, it has more efficient implementation of distributed storage and transmission, and it contributed to the unique role of decentralized subject free value flow, Randolf Liang considered it as a breakthrough in innovation. It is a technology for exploring space with infinite value, which deserves long-term attention and can be landing.

Randolf Liang anchored his key focus to Ripple and Stellar, and used his free time to launch the RippleFox community in China, bringing together a group of early Chinese enthusiasts who are focus on blockchain technology and Ripple and Stellar technology. A community of great learning atmosphere has been formed.

With the development of the community and the convergence of various types of talents, the community naturally had more than just paying attention to research and they had to do some real things. As a community creator, Randolf Liang began to choose excellent talents from the community. They have carried out some discussion on the project, and focus on the application of blockchain technology.

In the meantime, due to Randolf Liang’s technical attention to Ripple and his professional technical ability, Wanxiang Blockchain Lab hired him as a researcher and he participated in the preparation of the white paper on China’s blockchain technology and application development. He became a veritable industry expert, the dream of his technology changes the world has futher landed.

After a deep study in blockchain, Randolf Liang has already focused on the supply chain financial business application based on blockchain technology with his community partners. He has successively undertaken strategic consulting and technical architecture design for several blockchain financial business solutions of listed companies. Randolf Liang has accumulated rich practical experience and the business processes of these listed companies have been optimized, and the operational efficiency has been improved, which has brought great returns.

At this time, Randolf Liang and his friends are filled with confidence in solving more problems with blockchain, and in Randolf Liang’s heart, the pursuit of “financial inclusive to the public” once again emerged, and he has had continuously discussion with his partners to explore and find a more universal tool and platform, so that more enterprises, especially small and medium-sized industrial enterprises can enjoy the results of blockchain technology advancement, and to enjoy the technology application with low cost and high efficiency, and have the ability to “self-financing “, to achieve the autonomy of its own development.

After experiencing countless days and nights of discussion, a next generation of self-financing protocol framework with technological innovation attributes has finally came out, Randolf Liang named it “Ultiledger”, a blockchain public chain platform with the dream of “Technology changes the world, the financial inclusive to the public” was born.

In the future, with the continuous maturity of Ultiledger’s public chain technology, more and more landing application scenarios will be happened, and the progress of application landing is closely related to the construction of the blockchain community. Based on the Ultiledger main chain and the open platform, and combined with global development co-builders, Ultiledger will build a sustainable blockchain community ecosystem.

In the future, with the continuous maturity of Ultiledger’s public chain technology, more and more landing application scenarios will be happened, and the progress of application landing is closely related to the construction of the blockchain community. Based on the Ultiledger main chain and the open platform, and combined with global development co-builders, Ultiledger will build a sustainable blockchain community ecosystem.