From the day when finance was created, it was the mission of promoting the value creation of human economic activities. It can be said that the promotion of financial value creation and the increase in efficiency are the genes of financial mission.

In ancient times, the economic activities between tribes and small cities were mainly reflected in their own autonomy and barter exchange without the financial needs of intermediates. With the progress of society, the scope of social and economic exchanges expanded, frequency increased and the emergence of currency etc., has led to the prosperity of economic activities and the emergence of financial needs.

On this basis, financial activities have occurred, especially in the era when the circulation of physical currency is not convenient. The financial means marked by credit endorsement can bring low-cost and high-efficiency credit authorization activities, thus promoting the creation of economic activities.

In the same period, the financial service system was born, including direct financial means represented by direct investment, and indirect financial services through institutions such as intermediary commercial banks. These two forms of financial services have also become the accompanying human economic and social value creation for a long time.

Looking back at the birth process of indirect financial services, it is the demand that the scope of traditional economic activities is expanded and frequently strengthened. However, the financial services represented by traditional direct investment cannot be effectively supported by technology, thus generating the demand for intermediate intermediary. Although the cost is increased, this cost is worthwhile compared to the final result of solving the problem.

It can be said that the existence of indirect financial services and intermediate intermediaries is essentially a balance between cost and effect output that cannot be de-intermediated by technology. This is also the foundation of indirect financial services institutions.

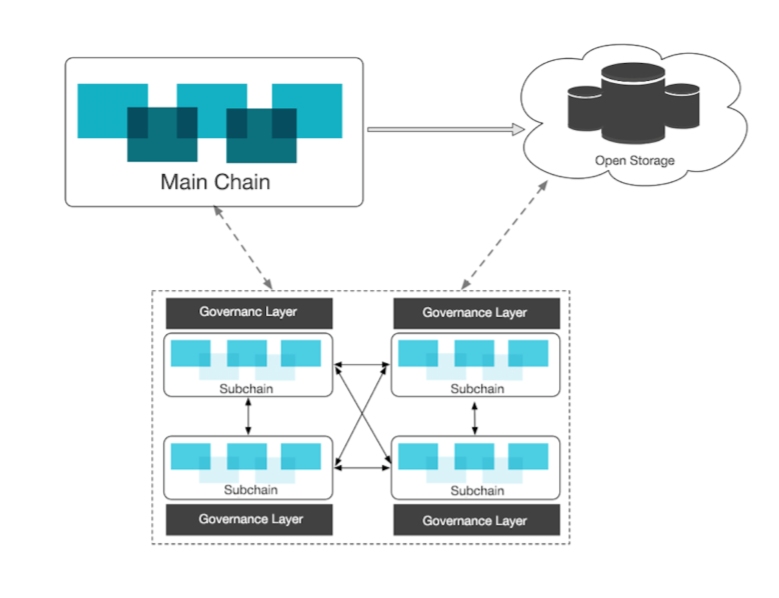

However, with the advancement of the times and technology, especially the advancement of Internet technology and blockchain technology, which bring universal spread of information Internet technology and the deep penetration of social and economic life, the transfer efficiency and the level of digitization of internal information of traditional self-economy have been greatly improved. At the same time, the point-to-point decentralized distributed storage and transaction system of the blockchain enables the realization of the “value Internet”, while achieving the free flow of value, also reducing the cost and improving the efficiency.

The transformative forces from technological empowerment are spurring the wave of de-intermediary transformation in the financial services.

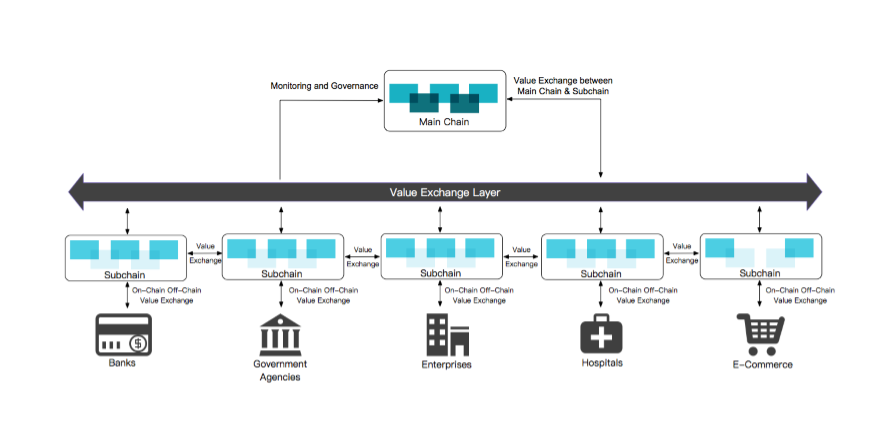

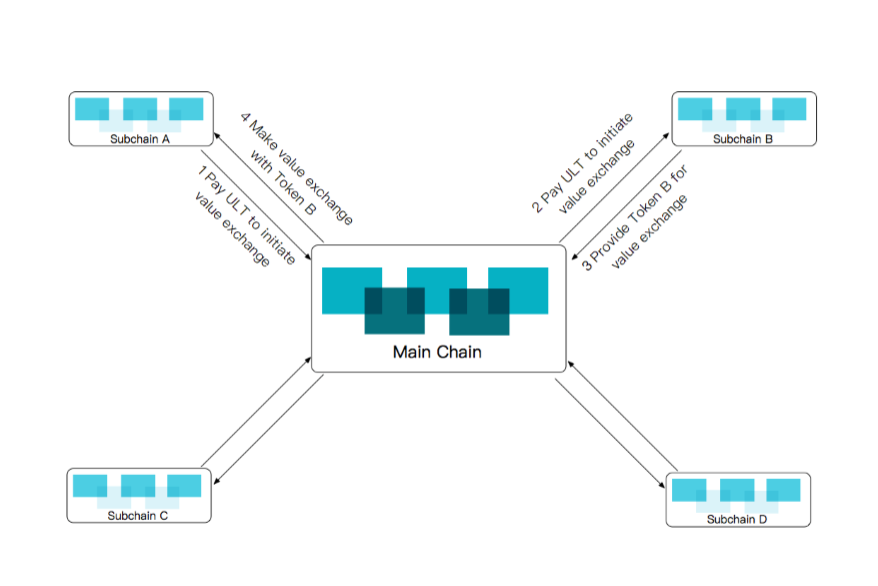

As the next generation of “self-finance” blockchain protocol, Ultiledger provides a new function to realize the “self-finance” capability of the economy through the underlying technology empowerment and platform support of the blockchain, making “self-finance” a kind of universal infrastructure, which can be easily enjoyed by the economy, it has no entry threshold, and is low in cost and high in efficiency, making “self-finance” an equal enjoyment for any entity in the society with a broad self-economy.

Ultiledger’s self-financing revolution from the economy is essentially a subversion of traditional indirect finance-led financial services. In the future, with the advancement of the Ultiledger platform, when a large number of self-employed economies have the self-solving ability of the flow of information and value circulation in its own development process by “self-financing”, and its demand for indirect finance is reduced to a minimum.

The revolution that Ultiledger brings is not only the empowerment of a company’s “self-finance” capabilities, but also a subversion of traditional direct finance, indirect finance, and self-financial model structure.

In the future, “self-finance” will become a universal, mainstream and basic form of financial services, and Ultiledger’s value increment will show exponential growth, and the final result will be “self-finance”, direct financial and Indirect finance provides a hierarchy and structure for supporting financial services, and will also bring a low cost and a high efficiency of the self economy society, so that the economic value increase brought to society will also be limitless.

Ultiledger empowers the economy with blockchain technology. The changes will involve the subversion of traditional financial services and become the emerging force that leads the changes in the world financial services landscape, and it will be the backbone.

The financial service pattern of the future economy will be reshuffled with the emergence of Ultiledger. This is a visible future and an inevitable occurrence.